CarOwnership is the originator of a considerable number of tax efficient innovations applicable to Employee Car Ownership Scheme methodologies. We are registered with HM Revenue and Customs as the scheme promoter under scheme reference number 98746649.

"We were impressed with ECOS's in-depth technical mastery of their brief particularly in respect of the tax and national insurance complications surrounding this whole issue. But more to the point, so were the most senior officials from HM Revenue and Customs with whom we had to deal to secure their approval of our scheme"

Benefit without necessarily changing your current provider

If you operate an existing scheme with a major leasing company or are considering introducing one, we guarantee to save you money. This will be in addition to any ‘off the shelf’ solution from a leasing company.

References

We have a number of major blue chip clients who are delighted to act as reference sites for us. If you would like to talk to them contact us and we’ll put you in touch.

HM Revenue & Customs

The majority of Employee Car Ownership Schemes in the UK are run in conjunction with major leasing companies. As legislation and HM Revenue and Custom practice has evolved over the last few years, the leasing companies’ scheme architecture has failed to do so.

All of the schemes we have examined in the last few years have design flaws that, subject to agreeing satisfactory non-compete and confidentiality agreements with the leasing providers, we have been able to rectify.

Additional efficiencies

In addition, we have been able to deliver considerable additional savings for our clients by removing some of the secondary tax costs associated with Employee Car Ownership Schemes. Our average saving for clients who were already operating Employee Car Ownership Schemes is now around £900 per car, per annum without necessarily the need to change provider.

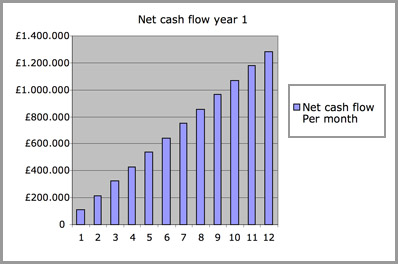

Return on investment

The nature of Employee Car Ownership Schemes means that scheme design is bespoke to each client. However, the saving available to one of our recent clients that already operates an Employee Car Ownership Scheme is shown here: